Double Choke Point: Demand for Energy Tests Water Supply and Economic Stability in China and the U.S.

The cords of energy demand and water supply are tightening around the world’s two largest economies.

By Keith Schneider

Circle of Blue

The coal mines of Inner Mongolia, China and the oil and gas fields of the northern Great Plains in the United States are separated by 11,200 kilometers (7,000 miles) of ocean and 5,600 kilometers (3,500 miles) of land.

But, in form and function, the two fossil fuel development zones—the newest and largest in both nations—are illustrations of the escalating clash between energy demand and freshwater supplies that confront the stability of the world’s two biggest economies. How each nation responds will profoundly influence energy prices, food production, and economic security not only in their domestic markets, but also across the globe.

Both energy zones require enormous quantities of water—to mine, process, and use coal; to drill, fracture, and release oil and natural gas from deep layers of shale. Both zones also occur in some of the driest regions in China and the U.S. And both zones reflect national priorities on fossil fuel production that are causing prodigious damage to the environment and putting enormous upward pressure on energy prices and inflation in China and the United States, say economists and scholars.

“To what degree is China taking into account the rising cost of energy as a factor in rising overall prices in their economy?” David Fridley said in an interview with Circle of Blue. Fridley is a staff scientist in the China Energy Group at Lawrence Berkeley National Laboratory in California. “What level of aggregate energy cost increases can China sustain before they tip over?”

“That’s where China’s next decade is heading—accommodating rising energy costs,” he added. “We’re already there in the United States. In 13 months, we’ll be fully in recession in this country; 9 percent of our GDP is energy costs. That’s higher than it’s been. When energy costs reach eight to nine percent of GDP, as they have in 2011, the economy is pushed into recession within a year.”

Economies of Scale

China is growing and modernizing at a pace and scale never before seen in history, while the U.S. is mired in an economic downturn, caused largely by rising energy prices.

Indeed, given the different economic circumstances that grip both countries—one soaring and the other in a serious slump—they nevertheless view energy production as the top national priority. Growth and development at such a scale demand innumerable resources, particularly water. As a result, the water needs of Chinese and American energy producers take precedence over any other economic sector.

“The United States confronts the same kind of resource conflicts as China,” Fridley said. “There are increasing expectations of confrontation over water as a factor in energy production.”

Coal production in Inner Mongolia and shale oil drilling in the northern Great Plains reflect this homage to carbon-based fuels. The development of carbon resources in both regions uses more water than any other industrial sector except agriculture. It also is pouring into the atmosphere millions of metric tons of the climate-changing gases that climatologists say are warming the planet, changing patterns of precipitation, and increasing the intensity of droughts and storms.

The extremes in weather, in turn, make it even more difficult to generate carbon-based energy as severe droughts affect mining and drilling operations.

Yet, by insisting on developing new sources of carbon-based fuels that are drawn essentially from the desert both nations are testing the limits of their national water reserves and challenging the capacity of other important economic sectors—agriculture, large metropolitan regions, major manufacturers—to use much less water.

“China’s continued growth and stability hinge on finding a more sustainable strategy to cope with its water and energy demand,” Parag Khanna told Circle of Blue. Khanna is an author, global strategist, and senior research fellow at the Washington, D.C.-based New America Foundation. “The external risk of friction with its southern neighbors over water diversions and internal tensions due to falling water supply and environmental pollution are both growing.”

Droughts Affecting Fossil Fuel Development

Despite national agendas that are focused on domestic energy security, there are a score of environmental, economic, and political impediments that lie in the path to large increases in Chinese and American energy production.

Few, though, are more significant than the steadily diminishing reserves of fresh water in both countries. China lost 35 billion cubic meters (9.3 trillion gallons) of water every year over the past decade, according to figures from the National Bureau of Statistics. The U.S. also lost water, a total of 19 billion cubic meters (5.02 trillion gallons) in the period from 1985 to 2005.

In the last year, energy-water choke points have become more urgent and visible in both countries.

From January to June, a severe drought in southern China not only reduced hydroelectric generation in the Yangtze River Basin, but low water levels also curtailed coal shipments to manufacturers and power plants down river. Similarly, northern China endured its driest winter in the past 60 years, which put pressure on already limited water resources used by coal producers. This led to further coal supply reductions, higher coal prices, and contributed to inflation.

Though coal prices are soaring, China’s energy producers can’t raise consumer prices because of tight state control over electricity fees. Instead, they are cutting power output to save money.

In May, China’s top five power utilities—which generate half of the country’s electricity—reported $US 1.62 billion (RMB 10.5 billion) worth of losses in their coal-fired power plants during the first four months of the year, according to the Xinhua News Agency. China’s main electricity distribution company, the State Grid, warned that power shortages this year could reach 30 to 40 gigawatts, even if coal and water supplies are normal for the rest of the season.

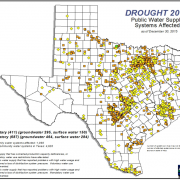

Texas has faced similar drought conditions. The period from October to May has been the driest since the state began keeping records in 1895, according to Texas A&M University.

The Texas drought is prompting shale oil and gas producers to seek tens of millions of gallons of water from farmers. The water is needed for hydraulic fracturing—the process of injecting water, chemicals, and sand at high pressure into sedimentary rock formations to free up the oil and natural gas trapped inside.

As the price of water is climbing, farmers and ranchers are deciding how much they are willing to sell.

In 2009, there were 358 natural gas drilling rigs in Texas alone, and that number had increased to 709 rigs by 2010, according to the Natural Gas Supply Association. Each rig can drill multiple wells in a year and each well typically uses upwards of 19,000 cubic meters (5 million gallons) of water for “fracking.” In southern Texas’ Eagle Ford Shale, however, fracking one well can use as many as 49,000 cubic meters (13 million gallons), due to the region’s unusual geology.

Additionally, because of the severe drought in Texas, water supplies have become a big issue for opponents of a coal-fired power plant proposed for Matagorda County. On June 16, the Lower Colorado River Authority (LCRA) delayed a vote to decide whether to sell more than 30 million cubic meters (8 billion gallons) of water per year to the owners of the planned White Stallion generating station.

“This delay is a victory for those opposing the coal plant and a step in the right direction in convincing the LCRA that this project is not a beneficial or responsible use of water from the Colorado River Basin,” Ryan Rittenhouse wrote in an article for TexasVox, an online publication of Public Citizen in Texas.

Droughts Affecting Hydropower Generation—Three Gorges and Hoover Dams

In both China and the United States, hydropower is a significant source of energy that does not rely on carbon-based fuels. But this spring’s drought in central and eastern China has crippled hydroelectric power generation throughout the Yangtze River Basin, creating a power deficit, the effects reverberated across the country.

In late May, the operators of China’s Three Gorges Dam began releasing torrents of water to revive the drought-depleted Yangtze River and to protect water supplies for downstream farms, fisheries, people, and livestock. Since January, more than 19 billion cubic meters (5 trillion gallons) of water have been released from the world’s biggest dam to China’s largest river, with 5 billion cubic meters (1.3 trillion gallons) flowing just in the last few weeks.

The emergency action had a cascading effect on the country’s energy supply. At the peak of the drought, water levels at the reservoir had dropped four meters (13 feet) below the minimum level needed to operate its turbines efficiently. Hydroelectrical output fell during the time of year when output should be at its highest: spring melt. According to official figures, nearly 1,400 dams in Hubei Province—home of the Three Gorges—do not have enough water to generate any electricity at all, Reuters reported.

To compensate, China has increased electricity prices and cut diesel exports by half, making the fuel available for domestic power generation. As a result, analysts speaking with Bloomberg News predicted rising demand for coal. Still, the seven-month drought has China bracing for its worst summer of power outages since 2004.

Though they did not endure power cuts, water and power customers in the American Southwest can certainly commiserate. Just eight months ago, water levels in Lake Mead—the reservoir behind the Hoover Dam—dropped to record lows and came within two meters (six feet) of triggering a first-ever shortage declaration on the Colorado River.

The Colorado River Basin supports more than 30 million people and irrigates a $US 3 billion agricultural industry. Dams in the basin, including the Hoover Dam, are a key source of base-load power for much of the Southwest.

Electrical generation at the Hoover Dam fell steadily during the decade-long drought, with its output in 2009 registering 30 percent lower than in 1999. Like their Chinese counterparts, utilities in the Southwest turned to fossil fuels to make up the shortfall. If climate change, as it is widely assumed, causes river flows to decline even further, lower-than-capacity electrical generation could be the new standard in both countries.

Regional Droughts—What Do They Mean?

The regional droughts are a warning of the much bigger energy production and economic challenge facing both nations, according to Fridley.

“People say to me, ‘Oh, you’re so negative.’ I say, ‘Let’s face up to what we’re up against,’” Fridley said. “It’s energy. It’s food. It’s water.”

Adequate water supplies are more essential than ever for producing energy from reserves of coal, oil, and natural gas that are increasingly difficult to tap, process, and move to market. Both nations are trying to stave off energy shortages that would drive prices to such a high level that their economies could tilt to sharp and enduring declines.

“I don’t see how you can look in-depth at these issues of water use and not understand—we do not make water,” Fridley said. “We have a problem that, to me, is going to force us to be much more mature about how we live and what we need to change.”

Solutions: China Ahead of U.S.

Though both nations are investing in water-sipping and much cleaner renewable energy sources—particularly solar and wind production—make no mistake about their primary economic objectives. China and the United States are pursuing development strategies largely devoted, at least for the next two decades, to perpetuating the fossil fuel economies of the 20th century.

In both countries, freshwater reserves are in erratic supply in important energy-producing regions—northern China’s coalfields and southern China’s hydropower region; the oil shale region of the northern Great Plains and the coal fields of the Rocky Mountain West.

While China and the U.S. share many of the broad trends in energy production and water supply, there are big differences when it comes to anticipating and developing rational responses to the tightening choke points between these two critical resources.

China’s business, provincial, and central government leadership have developed a long-term growth plan, and a number of the conservation steps that have been enforced have actually worked:

- Since 1995, China’s economy grew eight-fold, but its water consumption increased about 1 percent a year, or just less than 16 percent over 15 years.

- China’s big northern cities, led by Beijing, are developing innovative water recycling programs to convert wastewater to gray water, which can be used for flushing toilets, washing cars, and landscaping.

- Big industrial plants are required to recycle nearly all of the water they use in manufacturing steel, cement, glass, vehicles, and other products.

And China is not afraid of acting quickly to avoid making its water shortages worse. For instance, as recently as 2008, China had planned to build a total of 23 large coal-to-liquids refineries, where, instead of being burned for power generation, coal is pulverized to dust, mixed with water, and heated to produce diesel fuel. At first, the pay-off seemed well worth it—roughly $US 50 a barrel to produce in the current $US 112-per-barrel global oil market—until the water investment was assessed.

When Chinese authorities learned that an operational refinery—owned by Shenhua Group, China’s largest coal producer—annually used 10 million cubic meters (2.6 billion gallons) of water to convert 4.1 million metric tons (4.5 million short tons) of coal into 1.1 million metric tons (1.2 million short tons) of diesel, the government curtailed the program.

Just three other coal-to-liquids plants, already under construction and much smaller than the Shenhua plant, were allowed to proceed to completion.

In contrast, there has been a surprising lack of urgency among U.S. state and federal leaders despite clear evidence of rising energy demand and diminishing freshwater. Within the last year, however, administrative changes have been proposed to prod the government to do more to understand the trend:

- The U.S. Department of Energy has deliberately prevented public disclosure of an important 2009 study—commissioned by Congress in 2005—to develop a scientific roadmap to outline the areas of research that should be pursued to resolve energy-water choke points.

- In June, the U.S. Senate began considering the Energy and Water Integration Act, legislation that would mandate more studies on water and energy efficiency, conservation, current water use for energy production—both in transport fuels and electricity generation—and technological evaluations. Under the Senate proposal, some of the research production would be shifted to the National Academy of Sciences, but the Department of Energy would retain responsibility for the roadmap report.

Perpetual Fossil Fuels and Chronic Water Shortages

By no means, though, does China have all the answers. While China is doing a better job than the United States in anticipating and responding to new trends, neither country is close to resolving the confrontation between rising energy demand and unstable freshwater reserves.

Unless China either gets much wetter or pushes harder to conserve water or more speedily develops bigger wind, solar, and seawater-cooled nuclear sectors—which do not use much fresh water—the country faces a crippling energy shortage by the end of the decade.

Because of its prominence as the world’s largest market for food, energy, steel, cement, cars, trains, and other goods, how China resolves the confrontation between rising energy demand and scarce water supplies will affect not only the economy of the United States, but also those of almost every other industrialized nation.

“China recognizes the sheer magnitude of extracting as much coal as it is now in a single year,” concluded David Fridley of Lawrence Berkeley National Laboratory. “They have talked about capping coal production at 3.6 billion metric tons annually in the new Five-Year Plan. It’s not at all clear from their available water supply, transportation limits, and production costs that they can sustain coal production at 4 billion metric tons per year for even a couple of years.

“All of these limits feed into price increases that can change behavior before China runs into an absolute energy shortage,” Fridley added. “That’s what we don’t know—will price impacts be enough to change behavior? Or will there be absolute energy shortages?”

This post has been revised to reflect the following update:

Update: August 15, 2011

An earlier version of this article, based on coal sector industry data, reported that China’s coal industries used 138 billion cubic meters of water in 2010. Newer data by government agencies put water use by the coal sector at 120 billion cubic meters annually.

Contributions by Aubrey Ann Parker, Brett Walton, Nadya Ivanova, and Travis Miller—reporters for Circle of Blue. Also from Jennifer Turner, Washington, D.C.-based director of the China Environment Forum at the Woodrow Wilson International Center for Scholars.

Circle of Blue’s senior editor and chief correspondent based in Traverse City, Michigan. He has reported on the contest for energy, food, and water in the era of climate change from six continents. Contact

Keith Schneider

Leave a Reply

Want to join the discussion?Feel free to contribute!